WELCOME TO LIVING LIES DEFEND THE FORECLOSURE KEEP YOUR HOME!!! Over 17,000,000 Visitors Most of the claims that use "securitization" as a foundation are FALSE!! That means they have no right to administer, collect or enforce any debt, note, mortgage or deed of trust.And THAT means you can successfully challenge foreclosures AND pursue damages against those who make false claims.…[...]

Continue Reading

Continue Reading

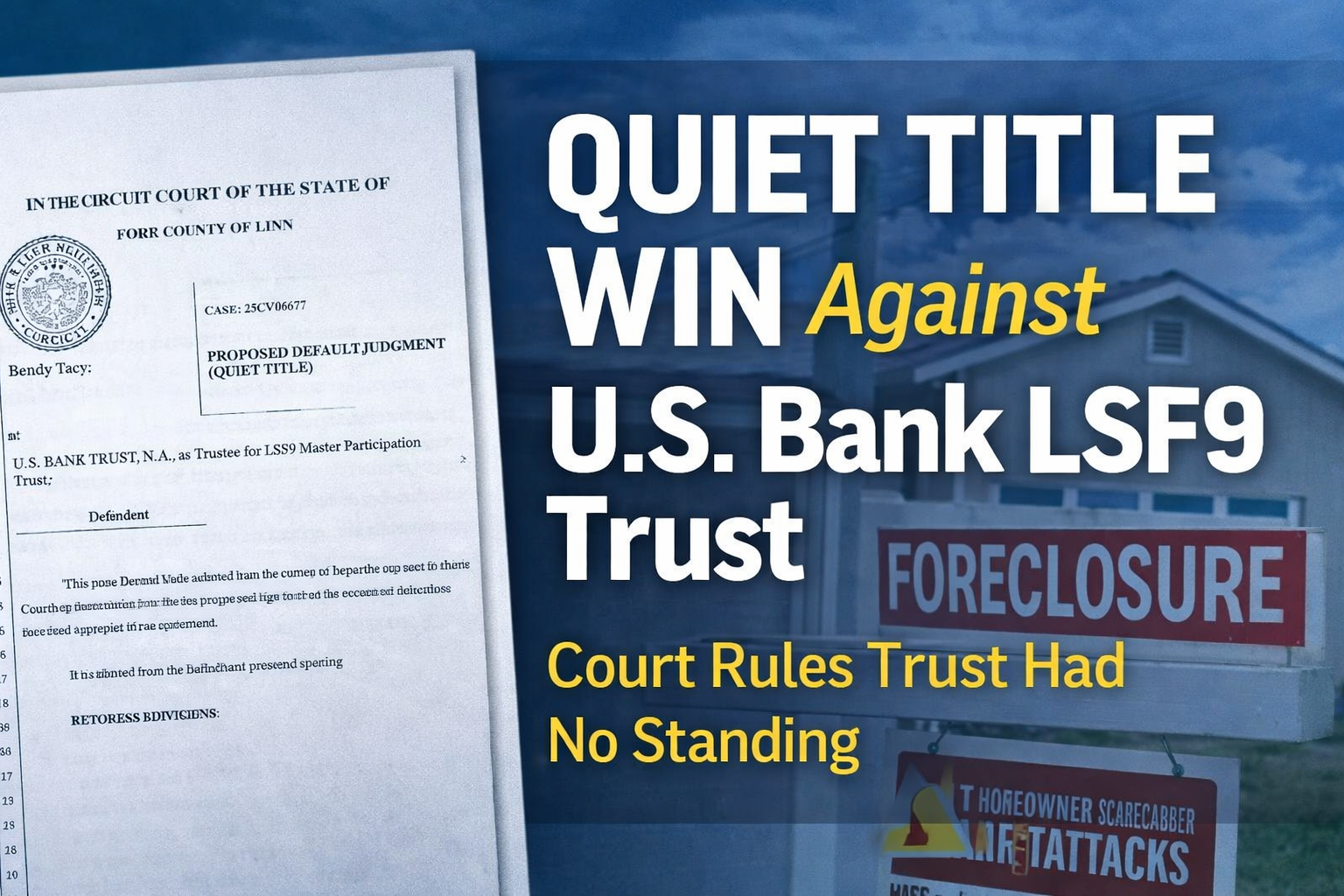

We are proud to report another win for one of our clients. A homeowner who refused to accept a paper claim from a Wall Street trust that could not prove its rights. This case was filed in the Circuit Court of the State of Oregon for the County of Linn, Case No. 25CV60677. Our client homeowner brought a quiet title…[...]

We are proud to report another win for one of our clients. A homeowner who refused to accept a paper claim from a Wall Street trust that could not prove its rights. This case was filed in the Circuit Court of the State of Oregon for the County of Linn, Case No. 25CV60677. Our client homeowner brought a quiet title…[...]Continue Reading

Why So Many Pro Se Homeowners Lose in Court — and How to Avoid the Most Common Mistakes

Feb 10, 2026

Every week, homeowners representing themselves in foreclosure court tell the same story. They knew something was wrong. The bank’s paperwork didn’t make sense. The numbers didn’t add up. The story kept changing. And yet—they lost. Not because they were wrong. But because the court never heard the right evidence, presented the right way, at the right time. This article explains…[...]

Every week, homeowners representing themselves in foreclosure court tell the same story. They knew something was wrong. The bank’s paperwork didn’t make sense. The numbers didn’t add up. The story kept changing. And yet—they lost. Not because they were wrong. But because the court never heard the right evidence, presented the right way, at the right time. This article explains…[...]Continue Reading

By Donna Steenkamp, Head of Research at Livinglies. Many homeowners believe that once a foreclosure is over, the only option left is to walk away. That isn’t always true. In some cases, a quiet title action can undo the legal damage of an illegal foreclosure. But in other cases, it fails—and can even make things worse. The difference is not…[...]

By Donna Steenkamp, Head of Research at Livinglies. Many homeowners believe that once a foreclosure is over, the only option left is to walk away. That isn’t always true. In some cases, a quiet title action can undo the legal damage of an illegal foreclosure. But in other cases, it fails—and can even make things worse. The difference is not…[...]Continue Reading

Foreclosure Defense Cost for Homeowners: What It Really Costs—and What’s Worth Paying For

Jan 27, 2026

One of the first questions homeowners ask when facing foreclosure is this: “How much is foreclosure defense going to cost me?” That’s the wrong question. The right question is: “What am I paying for—and what actually protects my home?” Because in foreclosure, the cheapest option is often the most expensive mistake. If you want the foundation first, start here: Foreclosure…[...]

One of the first questions homeowners ask when facing foreclosure is this: “How much is foreclosure defense going to cost me?” That’s the wrong question. The right question is: “What am I paying for—and what actually protects my home?” Because in foreclosure, the cheapest option is often the most expensive mistake. If you want the foundation first, start here: Foreclosure…[...]Continue Reading

discovery evidence expert witness Fabrication of documents foreclosure defenses Foreclosure Questions legal standing

Foreclosure Attorneys for Homeowners vs. Servicer Law Firms: Why the Playing Field Is Uneven

Jan 21, 2026

In the battle between the foreclosure attorney for the Homeowners vs the servicer many believe the courtroom is neutral. It isn’t. The foreclosure attorney for homeowners vs servicer law firms are not playing on an even field. In foreclosure litigation, there are two very different worlds colliding: Attorneys hired by homeowners trying to enforce the law High-volume servicer law firms…[...]

In the battle between the foreclosure attorney for the Homeowners vs the servicer many believe the courtroom is neutral. It isn’t. The foreclosure attorney for homeowners vs servicer law firms are not playing on an even field. In foreclosure litigation, there are two very different worlds colliding: Attorneys hired by homeowners trying to enforce the law High-volume servicer law firms…[...]Continue Reading

Most homeowners are never told this: Banks do not have unlimited time to foreclose. Every foreclosure case—judicial or non-judicial—is governed by a statute of limitations. That statute sets a deadline. Miss it, and the right to foreclose can be lost. Yet servicers routinely pretend the clock never started, was magically reset, or doesn’t apply to them at all. That’s wrong.…[...]

Most homeowners are never told this: Banks do not have unlimited time to foreclose. Every foreclosure case—judicial or non-judicial—is governed by a statute of limitations. That statute sets a deadline. Miss it, and the right to foreclose can be lost. Yet servicers routinely pretend the clock never started, was magically reset, or doesn’t apply to them at all. That’s wrong.…[...]Continue Reading

Most homeowners are told the same thing when they face a non-judicial foreclosure: “There’s nothing you can do. There’s no court case.” That statement is misleading. Non-judicial foreclosure is harder to defend than judicial foreclosure—but it is not immune from challenge, and the foreclosing party still must follow the law. If you want a deeper walkthrough of the basics, start…[...]

Most homeowners are told the same thing when they face a non-judicial foreclosure: “There’s nothing you can do. There’s no court case.” That statement is misleading. Non-judicial foreclosure is harder to defend than judicial foreclosure—but it is not immune from challenge, and the foreclosing party still must follow the law. If you want a deeper walkthrough of the basics, start…[...]Continue Reading

By Donna Steenkamp One of the most common claims made in foreclosure cases is simple and dangerous: “We have the original note.” Judges hear it. Lawyers repeat it. Homeowners are told it ends the case. It doesn’t. That statement hides critical facts, ignores how modern mortgage transactions actually work, and often masks a complete failure of proof. The Myth of…[...]

By Donna Steenkamp One of the most common claims made in foreclosure cases is simple and dangerous: “We have the original note.” Judges hear it. Lawyers repeat it. Homeowners are told it ends the case. It doesn’t. That statement hides critical facts, ignores how modern mortgage transactions actually work, and often masks a complete failure of proof. The Myth of…[...]Continue Reading

Homeowners often hear “quiet title” and assume it’s a magic reset button. It can be. A quiet title action is a serious lawsuit about who legally owns the property. Used correctly, it can be powerful. Used incorrectly, it can get your case dismissed fast. This article explains, in plain English, what a quiet title action is, when it makes sense…[...]

Homeowners often hear “quiet title” and assume it’s a magic reset button. It can be. A quiet title action is a serious lawsuit about who legally owns the property. Used correctly, it can be powerful. Used incorrectly, it can get your case dismissed fast. This article explains, in plain English, what a quiet title action is, when it makes sense…[...]Continue Reading

If you’re behind on your mortgage or already facing foreclosure, it can feel like the bank holds all the power. But the truth is this: You still have rights. And you have more options than the servicer wants you to believe. This guide explains your strongest foreclosure defense strategies in 2025 — and how to get real help before it’s…[...]

Continue Reading

Continue Reading